Biography |

|

|---|---|

| Real Name | Gregory W. Becker. |

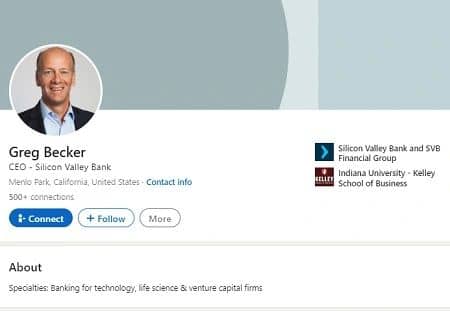

| Popular as | CEO of Silicon Valley Bank. |

| Age | 52. |

| Birth Date | 1970. |

| Birth Place | Indiana, United States. |

| Lives in | Menlo Park, California, United States. |

| Gender | Male. |

| Nationality | American. |

| Ethnicities | Caucasian. |

| Family | |

| Parents | Father: -- Mother: - |

| Follow on | |

| https://www.linkedin.com/in/beckergreg/ | |

| Love Life | |

| Marital Status | Married. |

| Wife | Name Unavailable. |

| Body Measurements | |

| Height | In feet: 5' 11". In centimeters: 180 cm. In meters: 1.8 m. |

| Weight | Kg: 70.3. Pounds: 155 lbs. |

| Eyes | Blue. |

| Hair | Black. |

| Education | |

| College | Indiana University - Kelley School of Business. |

| Career | |

| Works As | CEO At SVB. |

| Salary | $10,677,500. |

| Net Worth | $37.6 Million. |

![]()

Meet Silicon Valley Bank CEO Gregory W Becker

Greg Becker (born in 1970, age 52) is the CEO of America’s 16th largest bank Silicon Valley Bank (SVB), which recently collapsed like a house of cards. It has been termed the largest bank to fail since 2008. FYI, SVB is known for lending money to some of the greatest names in the tech industry, but the entire collapse took no more than 48 hours.

It all started when the bank shocked investors on March 8, 2023, by announcing that it needed to raise more than $2 billion in capital to counter losses from bond sales; the process got underway.

Clients of the bank started making hasty withdrawals out of fear. By March 9, the company’s shares tanked, 60% of shares were halted, and the feds seized control of the lender.

Some lucky customers could withdraw all their money, whereas some were not so fortunate; according to our sources, dozens of people were waiting in the rain to get their money. They got no money; instead, they met with representatives of FDIC who told them they could return on Monday and withdraw up to $250,000.

According to financial analyst S&P global market intelligence, 97% of SVB accounts exceed the $250,000 insurance limit. The FDIC says it’ll sell off SVB assets and distribute the money to those customers.

But this process could take weeks and even months, which is why the future of local startups is in peril. Elon Musk had shown interest in buying SVB, but the shareholders of Tesla Motors opposed his decision.

What Caused Silicon Valley Bank to Collapse?

The failure of Silicon Valley Bank has affected many lives and the future of startups. Many employers are worried about whether they will be able to pay their employees. But how did this downfall happen? According to reliable sources, several factors contributed to the collapse of SVB, including the absence of risk management oversight and a liquidity crisis.

From 2019 to 2021, Silicon Valley Bank saw a massive deposit surge: from $60 billion to $189 billion. This deposit increase was because venture capital funding exploded at that time, and startups were depositing millions of dollars with SVB.

The bank saw this deposit surge as an opportunity and invested $80 million in long-term mortgage-backed securities for around 1.5% interest.

Sadly the strategy backfired, and banks began experiencing a shortage in deposits. The problem persisted for a long time and, in March 2023, gave customers heebie-jeebies which led to a hasty withdrawal of funds, tanking the value of stocks.

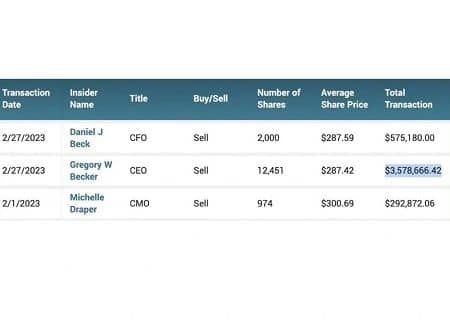

There are proofs that Greg Becker did benefit from insider trading from time to time. On February 27, 2023, when the average share price was $287.42, he dumped 12,451 shares for $3,578,666.42.

From Where is Greg Becker?

In 1970, Gregory W. Becker (age 52) was born in Indiana, United States. He experienced a wonderful childhood growing up in a wealthy family.

During his school days, Becker was an excellent student and graduated with flying colors in 1988. After high school, he joined Indiana University – Kelley School of Business to pursue B.S.-Business.

During his junior years, he interned at IBM in the accounting department. His time at IBM made him realize that accounting is not exciting. In 1992, Greg received his bachelor’s degree and began exploring job opportunities; soon, he joined a bank in Detroit.

How Much is Greg Becker’s Salary & Net Worth?

After working in Detroit, Greg received an opportunity to work as an associate; initially, he was skeptical, but he decided to keep his nervousness aside and accepted the chance. It was supposed to be a short-term assignment, but the deadline kept getting pushed, and eventually, Becker decided that he did not want to leave SVB.

Greg, who had joined Silicon Valley Bank as COO and CBO, assumed the role of President in 2008 and 3 years later became CEO; likewise, his salary also kept increasing. In 2015 he ranked 69th in Worth’s List of Most Powerful People in Finance.

According to Wallmine, in 2023, Gregory received $10,677,500/year as his salary. Currently, he lives with his wife and kids in Menlo Park, California, United States.

Greg Becker Q&A

Ques: Who is the CEO of SVB?

Ans: Greg Becker.

Ques: Will the government bail out SVB?

Ans: Janet Yellen, treasury secretary, released a statement stating that the government will not bail out SVB.

Ques: Where does Greg Becker live?

Ans: Menlo Park, California, United States.

Ques: What is Greg Becker’s net worth?

Ans: $37.6 million.